FRIDAY, MARCH 6, 2026

KEY NEWS FOR YOU TO USE

Lawmakers Knew

All Along

They Were Voting

to Cut Medicaid

for Older Adults

By Natalie Kean

Cutting federal Medicaid funding would put home and community-based services (HCBS) first on the chopping block. But lawmakers took to the airwaves dismissing these claims, asserting they were only cutting “wasteful” spending.

My clothes nowadays tend to be a mix of thrift shop, supermarket, high street, and the occasional splurge on something gorgeous! As I have saved money with reducing my overall clothing budget, I don’t feel guilty so just enjoy whatever I buy.

Read more

****

How to Avoid

Becoming

a Grumpy Old Man

Why Complaining Rewires Your Brain — and How to Stop It

Read more

****

Superagers

found to have

something other

older adults do not

By Bernie Tafoya

According to a study by researchers from the University of Illinois-Chicago, Northwestern University and the University of Washington, the brains of older adults with super healthy memories grow more neurons than those of their peers.

Read more

****

Social Security's

2026 COLA

Will Probably

Fail Retirees.

Here's Why

By Maurie Backman

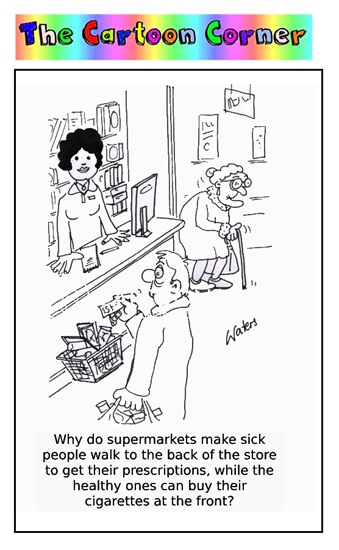

Healthcare costs could render this year's COLA useless, even if broad costs don't rise as much.

Read more

****

Older adults

gain muscle power

with daily servings

of everyday snack,

study finds

By Deirdre Bardolf

Adults 65 and older who consumed about three tablespoons of peanut butter for six months improved their performance on a key lower-body function test compared to a control group

↓

Quote___________________________

“The art of healing comes from nature,

not from the physician.

Therefore the physician must

start from nature,

with an open mind.”

Paracelsus

_______________________________

↓

I've lived over 70 years. In that time, I've seen at least seven big U.S. fights with other nations. Sure, most weren't popular. But Congress backed every one. That means the American people did too, in a technical sense. Today, we're in a war over 65% of folks hate. It's unpopular. And it's illegal.Continue reading>>

↓

IN CASE YOU MISSED IT

Unique Patterns

of Hearing Loss and

Cognition in Older Adults

By Keith Darrow

Read more

<<<<>>>>

16 Foods

That Boomers

Still Love

(Even Though Millennials

Mock Them)

By Anne Stewart

Read more

>>>><<<<

Are Older Drivers

Dangerous?

How to Sharpen

Your Driving Skills

After 60

By Joy Stephenson-Laws

Read more

>>>><<<<

Humans Could Live

to Be 150,

Science Says

But that’s absolutely

the limit.

By Caroline Delbert

Read more

>>>><<<<

Smart Ways

to Make the Most

of Your

Social Security Check

By Jordan Rosenfeld

Read more

↓

Healthiest & Unhealthiest Cities in America (2026)To determine which areas prioritize residents’ well-being, they compared more than 180 of the most populated U.S. cities across 41 key indicators of good health. Our data set ranges from the cost of a medical visit to fruit and vegetable consumption to the share of physically active adults.

Click here to see list >>

↓

↓

Next edition

MONDAY, MARCH 9 , 2026

©2026 Bruce Cooper

-30-

Comments

↓ ↓ ↓

WEDNESDAY, MARCH 4, 2026

KEY NEWS FOR YOU TO USE

Study finds

vegetarians over 80

less likely to reach 100

In very old age, staying strong and maintaining muscle matters more than long-term disease prevention.

Read more

****

There aren't enough

geriatricians

—how older adults

can still get the right care

By Jerry Gurwitz

You can use a few simple strategies that geriatricians rely on to have more productive conversations with your or your family member's doctor.

How to stop thinking about RMDs like it’s 2017, and why you should take advantage of the ‘golden years’ for Roth conversions.

Many immigrants with legal status have historically been eligible for Medicare, Medicaid, and tax credits for Affordable Care Act (ACA) insurance plans. This changed in July 2025

No, it’s not about holding a “Roman chair” pose, nor is it about doing ab exercises on a Swiss ball. Rather, it’s about one’s mental state.

Quote______________________

”I hate war as only a soldier

who has lived it can,

only as one who

has seen its brutality,

its futility, its stupidity.”

Dwight D. Eisenhower

___________________________

↓

This is another in our series of what to look for if you, or a loved one, are considering a move to an Assisted living Facility.

Selecting an A.L.F. for a loved one is a major life step. As with everything, you usually get what you pay for. Some spots cost eight thousand dollars a month or more and feel like a resort. They serve fine food and offer many daily events. These perks are nice, but they are not the main goal. Fancy rooms do not matter if the home is not safe. Safety for residents and staff must be the first thing you check.

Continue reading >>

↓

IN CASE YOU MISSED IT

US prostate cancer rates

rose annually over the

past decade, new report finds

By Dr. Raihan El-Naas

Read more

>>>>><<<<<

Cardiologists

Are Begging

You To Eat More of This

High-Fiber Food

if You're Over 60

By Korin Miller

Read more

>>>>><<<<<

GM Patents a Technology

That Would Tell Older Drivers

When to Give up the Car Keys

By Sean Tucker

Read More

<><><><><>

Why Are More

Older People Dying

After Falls?

Read more

>>>>><<<<<

Study:

More than half

of older adults

lose independence

after emergency surgery

By Donna Shryer

Read more

↓

Stats about Iran:

- Iran has an estimated population of around 85 million people, making it the 18th most populous country in the world.- Iran covers approximately 1.65 million square kilometers, making it the 17th largest country globally.- Iran's GDP is roughly $220 billion USD (nominal), with significant oil and gas reserves contributing to its economy.- The official language is Persian (Farsi), spoken by about 80% of the population.- The majority of Iranians are Shia Muslims, comprising approximately 90-95% of the population.↓